Panama Canal Drought Impacts

Recent droughts in the vicinity of the Panama Canal are exerting significant influences on the flow of freight through the region. Diminished water levels have resulted in heightened restrictions on vessels permitted to traverse the canal, both in terms of the types of vessels allowed and their daily allocation. Specifically, draft levels, which measure a ship’s submerged depth, have been reduced from 15.2 meters to 13.4 meters. Furthermore, the daily quota of transiting vessels has been capped at 32, in contrast to the customary ~36. In essence, fewer and less laden vessels can now navigate this pivotal shipping route, leading to disruptions within the supply chain.

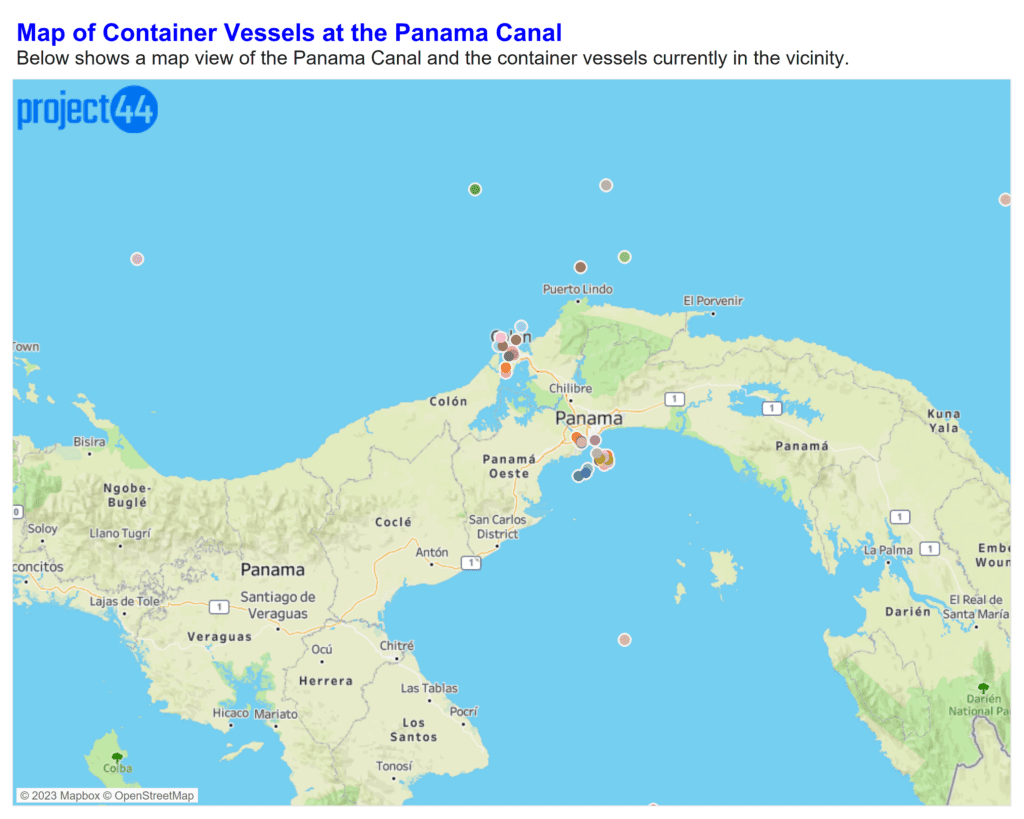

As illustrated in the map below, vessels are congregating on both sides of the canal, awaiting clearance for passage.

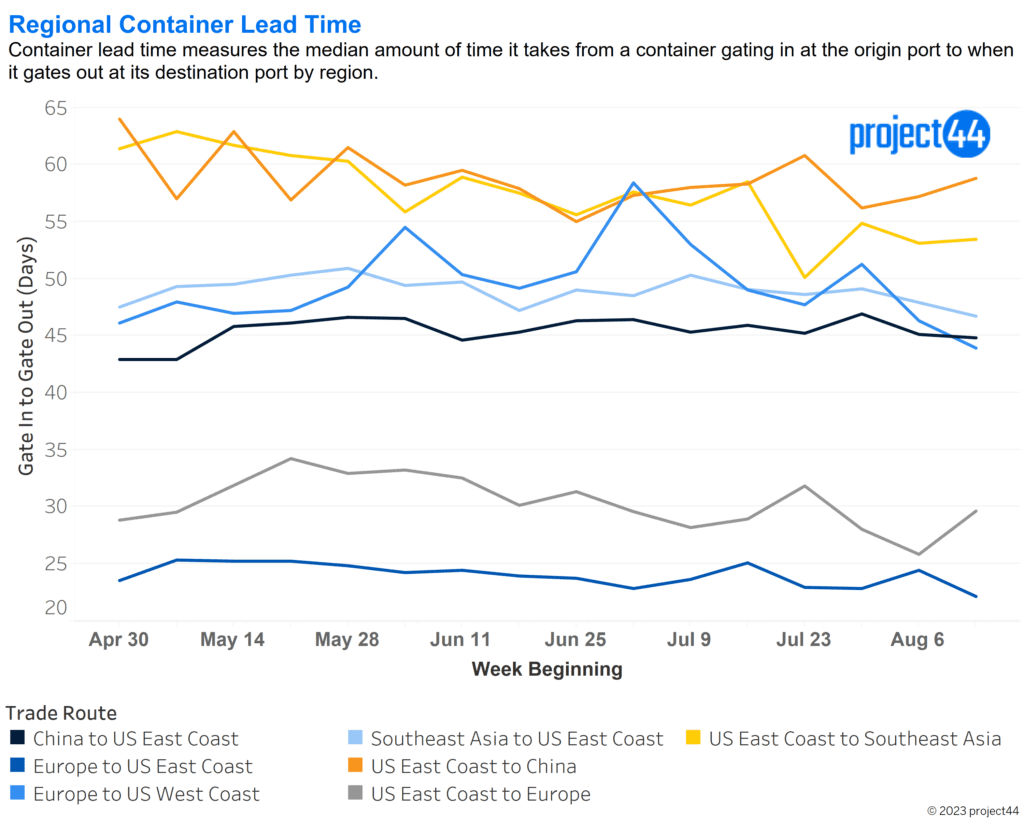

Initial reports indicate that wait times for certain vessels have reached as high as three weeks, but recent statistics from the Panama Canal Authority suggest a gradual reduction in these wait times. Nevertheless, the wait times still exceed normal parameters, and as these vessels reach their intended destinations, we anticipate spikes in the chart below, which monitors container lead times.

To date, container lead times have been minimally affected. However, it’s worth noting that lead time encompasses the duration from when a container is gated out at the destination port. Given that many of the affected containers have yet to undergo this process, we anticipate increases along the major routes reliant on the Panama Canal as these ships continue their transit.

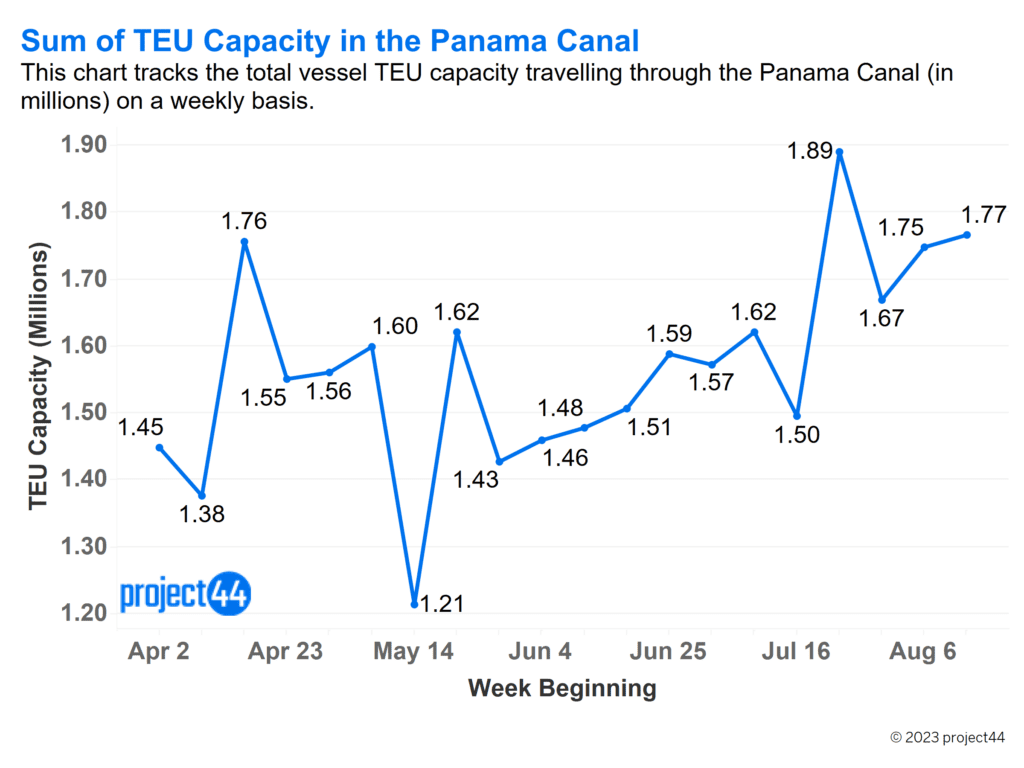

Volume Passing Through the Canal

Despite the newly imposed restrictions, there have been no significant disruptions to the total TEU (Twenty-Foot Equivalent Unit) capacity passing through the port. This figure remained constant at 1.77 million TEUs during the week of August 13th.

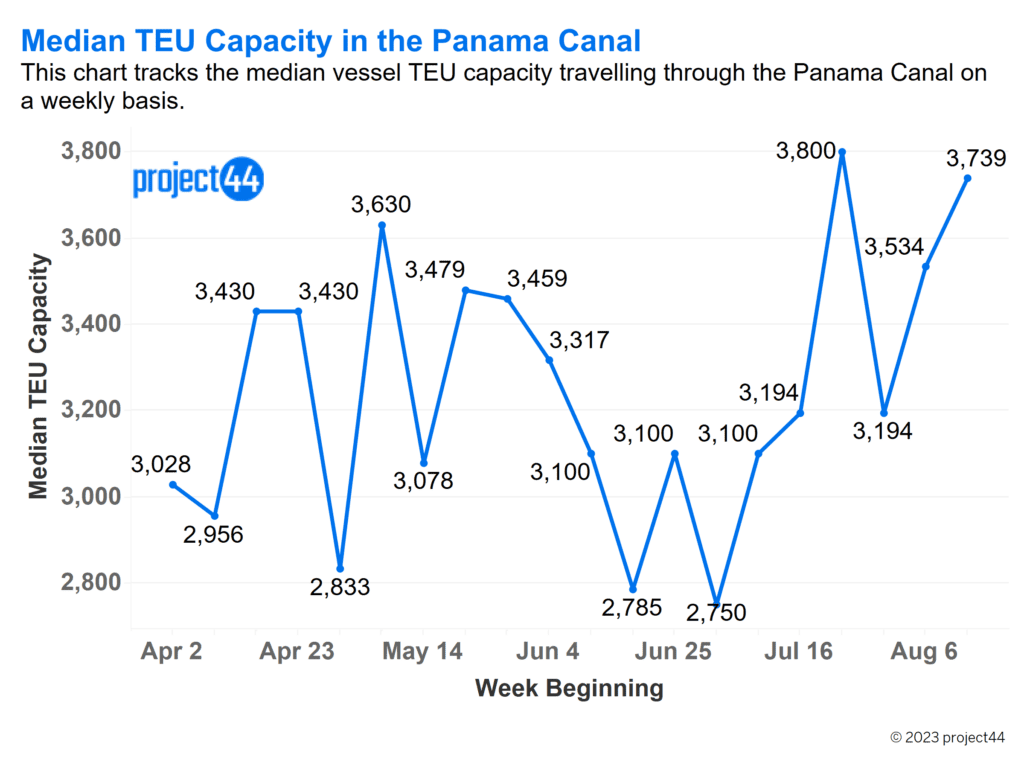

Furthermore, there have been no substantial alterations in the median TEU capacity for each vessel traversing the canal. This metric has predominantly held within the 3000s range, with the average TEU capacity hovering in the lower 5000s. This data underscores the consistent movement of Panamax vessels along this route.

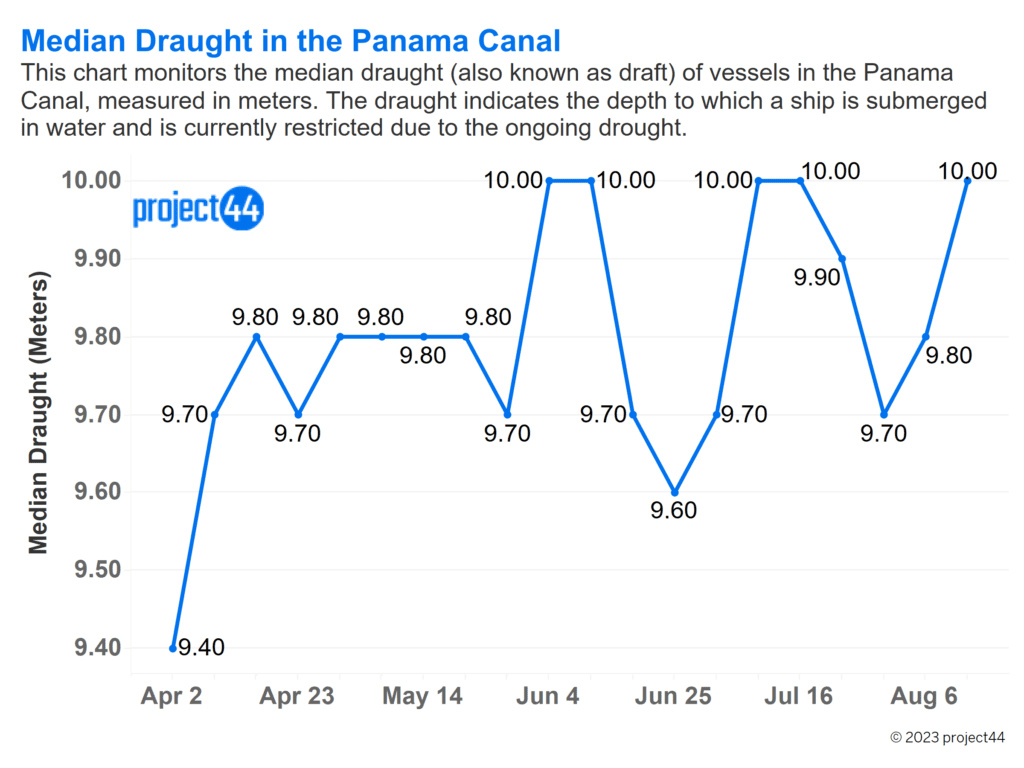

The marginal fluctuations in draft levels, as indicated below, continue to suggest that while lead times through the canal have been affected, the additional restrictions have not significantly impacted the overall volume passing through. The volume remains stable at present but is progressing at a slower pace.

Outlook

Recent droughts in the Panama Canal region have led to significant disruptions in the flow of freight. Lower water levels have resulted in stricter regulations on the types and numbers of vessels permitted to use the canal, with draft levels reduced from 15.2 meters to 13.4 meters, and a daily limit of 32 vessels, down from the usual ~36. This has caused congestion, with vessels waiting for weeks for passage. While container lead times have been minimally affected so far, there is anticipation of delays as ships reach their destinations. Surprisingly, the total TEU capacity passing through the canal has remained stable at 1.77 million TEUs, with median TEU capacity per vessel in the 3000s range, indicating that Panamax vessels continue to navigate the route despite slower progress due to the restrictions.

About project44

project44 is on a mission to make supply chains work. As the supply chain connective tissue, project44 operates the world’s most trusted end-to-end visibility platform that tracks more than 1 billion shipments annually for over 1,200 of the leading brands, including top companies in manufacturing, automotive, retail, life sciences, food & beverage, and oil, chemical & gas. Using project44, shippers and carriers across the globe drive greater predictability, resiliency and sustainability. To learn more, visit www.project44.com.

For questions or comments:

press@project44.com

Disclaimer: The information conveyed herein, shared solely for summary and not contractual purposes, comes from both project44 and third-party reporting. The project44 data does not include all available market information, and project44 has not undertaken to independently verify the third-party reporting. Similarly, this type of data changes from day-to-day. Accordingly, the reader should not rely on this reporting to make any business decisions, and project44 expressly disavows any liability arising from any such reliance.

Back to More