Key Takeaways

- Last mile on-time performance continues to increase year over year, though it has yet to return to pre-Covid norms.

- Increased carrier diversification is helping increase On-time Performance and allowing smaller shippers in the last mile space to grow.

- Click to Delivery time continues to improve partially due to the improved On-time Performance of carriers, but also because of improving operations and a more robust labor pool.

- Delays, Damages, and Delivered but Missing make up more than 70% of all complaints regarding last mile deliveries.

Last mile supply chain refers to the parcel delivery segment. This area of supply chain has been growing quickly over the past few years as more consumers prefer to shop online and have goods delivered directly to their door rather than shopping in a brick-and-mortar setting.

Covid-19 had a massive impact on this industry. While online shopping was mainstream prior to Covid-19, shutdowns caused nearly every non-essential business to focus on their online presence. And even where shutdowns weren’t widespread, the pandemic caused many shoppers to turn online to avoid crowded settings. As a result, volume spiked, and while the pandemic has receded, last mile is still feeling the effects today.

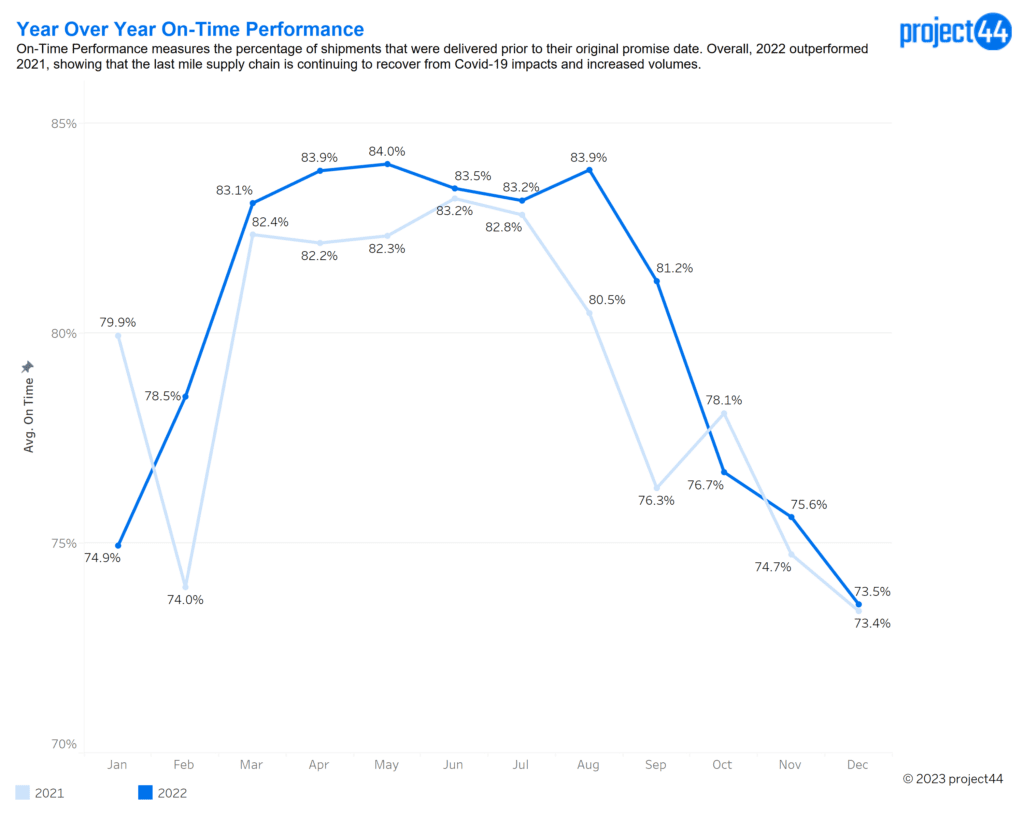

2022 On-Time Performance Outperforms 2021

Last mile On-time Performance measures the percentage of shipments that arrived by their initial promise date. Overall, 2022 outperformed 2021 in on-time performance.

Covid-19-related factors caused On-Time Performance to suffer beginning in 2020. Pre-covid, levels were consistently 85% to 90% outside of peak season, which runs from November through January. Since Covid-19, numbers have ranged from 70% to 84%. In 2022, OTP continued to inch back up towards pre-covid levels, but there is still a 6% difference between the pre-Covid max of 91% and the 2022 max of 84%.

2022 followed the same trends we’ve seen in years prior, which include a decline in On-time Performance for peak season due to the influx of holiday shipments and a drop in performance in the winter, generally attributed to inclement weather. January 2022 was particularly challenging with Snowstorm Izzy hitting the Northeast, Midwest, and South, and tornadoes striking parts of Alabama and Florida. After January, there was a consistent improvement over 2021 numbers.

While On-time Performance has not fully recovered to a pre-Covid normal, it continues to head in the right direction.

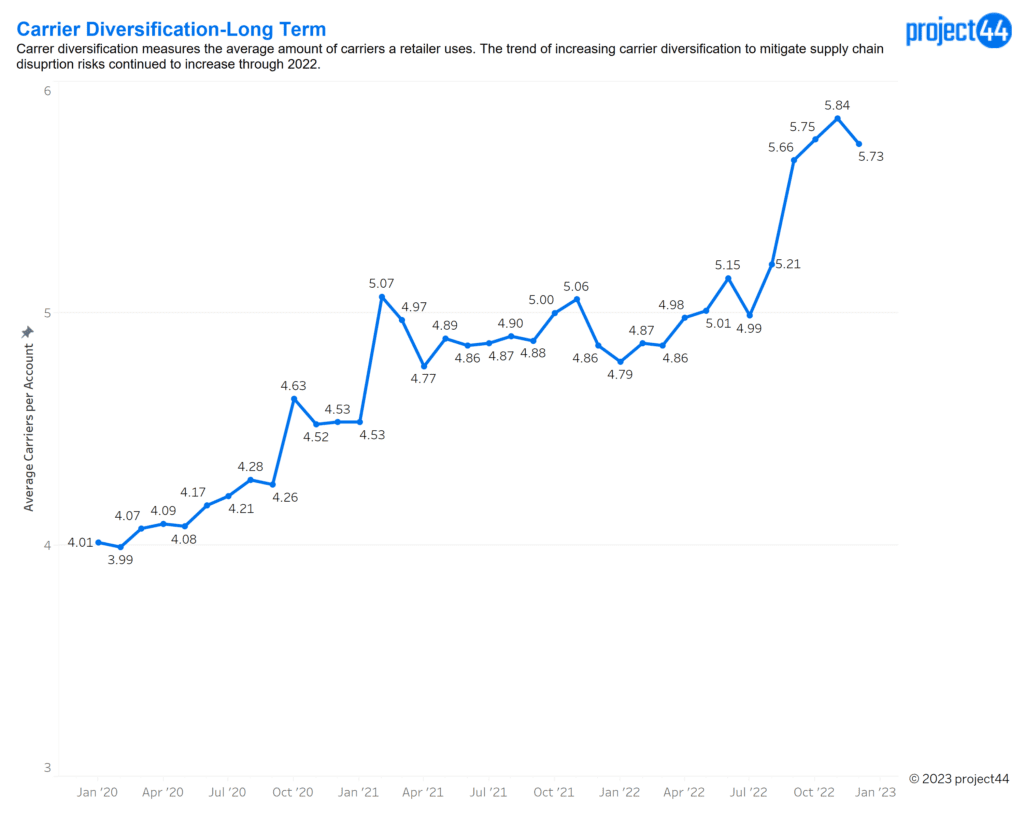

Retailers Continue to Increase their Carrier Pool

Carrier diversification measures the average number of carriers retailers use for their last mile business. To further mitigate pandemic-related risks, retailers opted for multiple carriers rather than depending on one or two as they may have done previously.

At the beginning of 2020, the average number of carriers per account was four. This has increased by more than 40% to nearly six carriers per account.

While the market is still dominated by a few major shippers, this has allowed some smaller companies to gain traction and growth in this leg of supply chain. The shift towards more carriers is one of the reasons for the steady increases in On-time Performance.

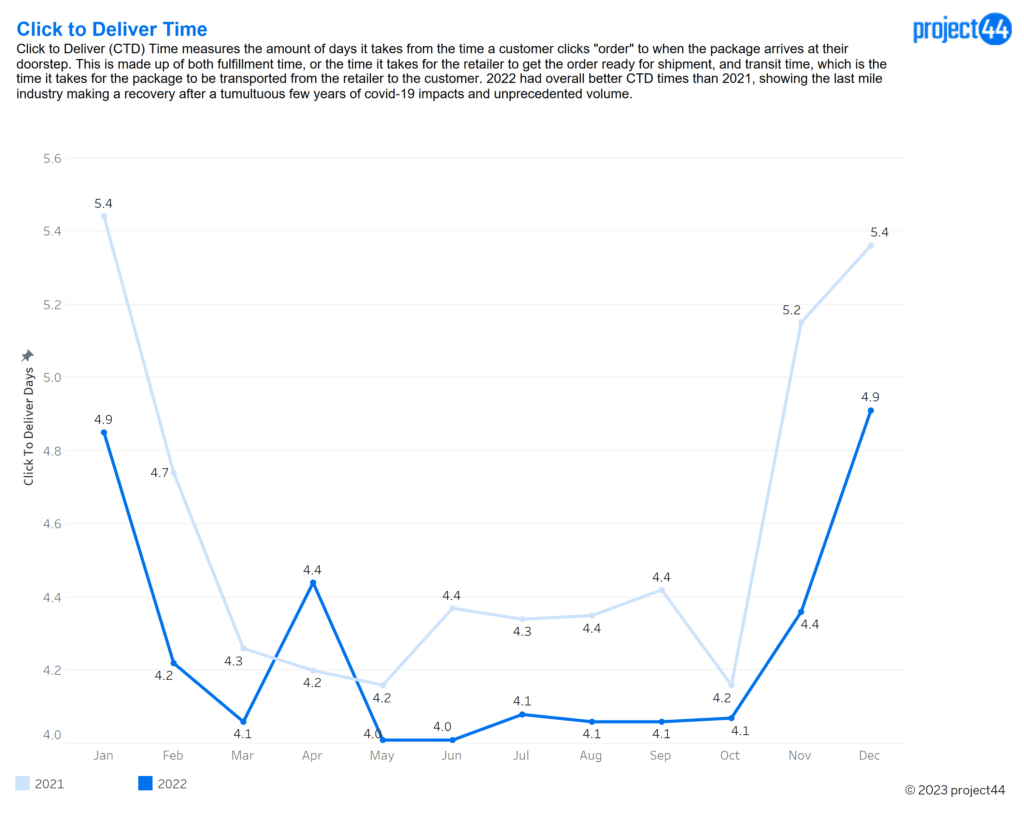

Click to Delivery Times Continue to Improve

Click to Delivery (CTD) time measures the amount of time between a customer hitting “order now” to when the package hits the doorstep. It is a combination of fulfillment time, or how long it takes the retailer to get the order ready for shipment, and transit time, which is the time it takes for the order to be shipped from the retailer to the customer.

Based on the improvements discussed in On-time Performance, it is not shocking to see the CTD time improve as well.

The other key factor in this equation is fulfillment time. While labor has consistently been a struggle, this leveled out more in 2022. During Covid-related labor shortages, there was a push to automate more functions within warehouse settings, like building out automated sorting lines or implementing robotics for picking. Due to better practices and an expanding labor pool, fulfillment dropped in 2022 compared to the year prior.

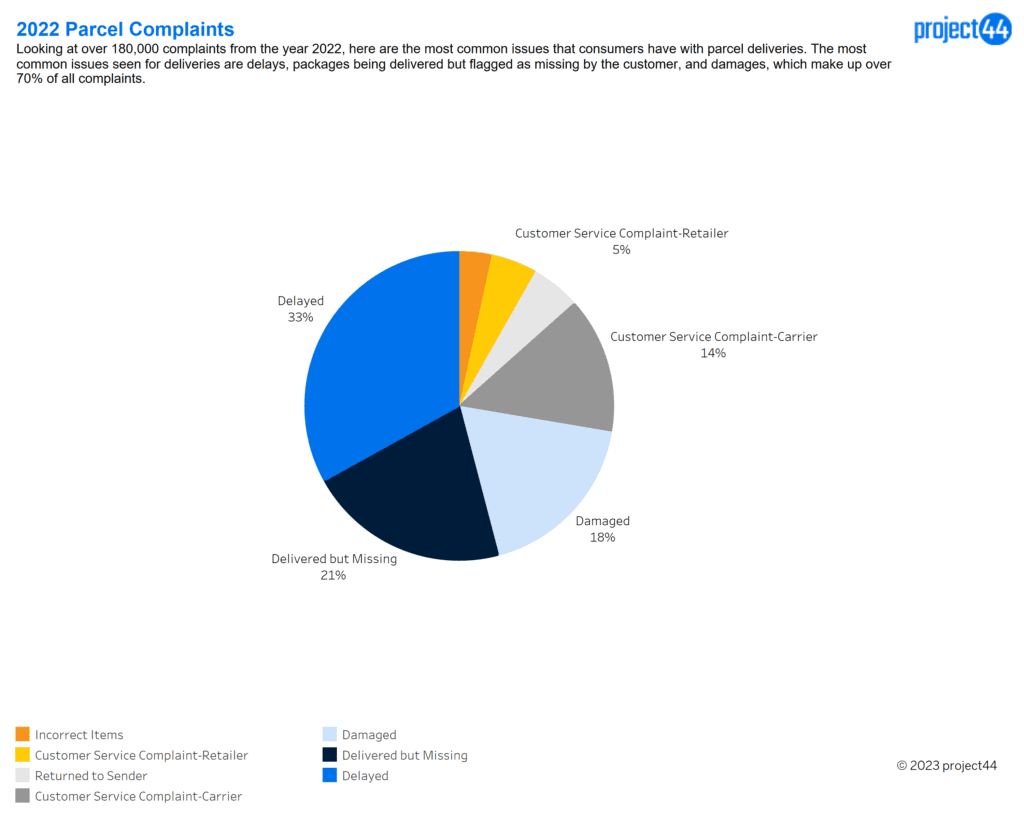

Porch Pirates, Delays, and Damages Elicit Complaints

While the last mile network continues to see promising improvements, it is not without its flaws. Hundreds of thousands of complaints are filed annually regarding package deliveries. The chart below illustrates the most common issues.

Delays make up the majority of complaints, followed closely by Delivered but Missing, and Damages. Damages can be improved by better packaging practices and improved handling of fragile goods while delays can be mitigated by more accurate lead time predictions and smoother retailer and carrier operations, but the Delivered but Missing bucket poses a challenge to retailers.

There is a growing trend of people stealing packages from people’s doorsteps, commonly called Porch Pirates. While this is similar to shrink seen in brick-and-mortar locations due to shoplifting, retailers have no way to control the security of an individual’s porch. Doorbell cameras are becoming more popular, but it still does not eliminate the issue. Retailers and carriers can help mitigate this risk by providing live updates and accurate ETAs regarding package delivery. This allows the customer to know exactly when to expect a shipment and limit the time it sits on their porch.

Back to More